In our area, the cost of title insurance is a negotiable item in the Tennessee Purchase & Sale Agreement. In other posts, we’ve discussed how to determine the cost of a policy, today we will talk about how to obtain a discount.

If there is a policy currently in place AND the policy is less than 10 years old, you may qualify for a reduced rate on the cost of the new policy. The discount is often referred to as a REISSUE CREDIT.

The amount of savings will vary from 10%-30% on a sliding scale depending on the age of the old policy. This could be several hundred dollars depending on the sales price, so it’s worth your time to investigate whether you may qualify.

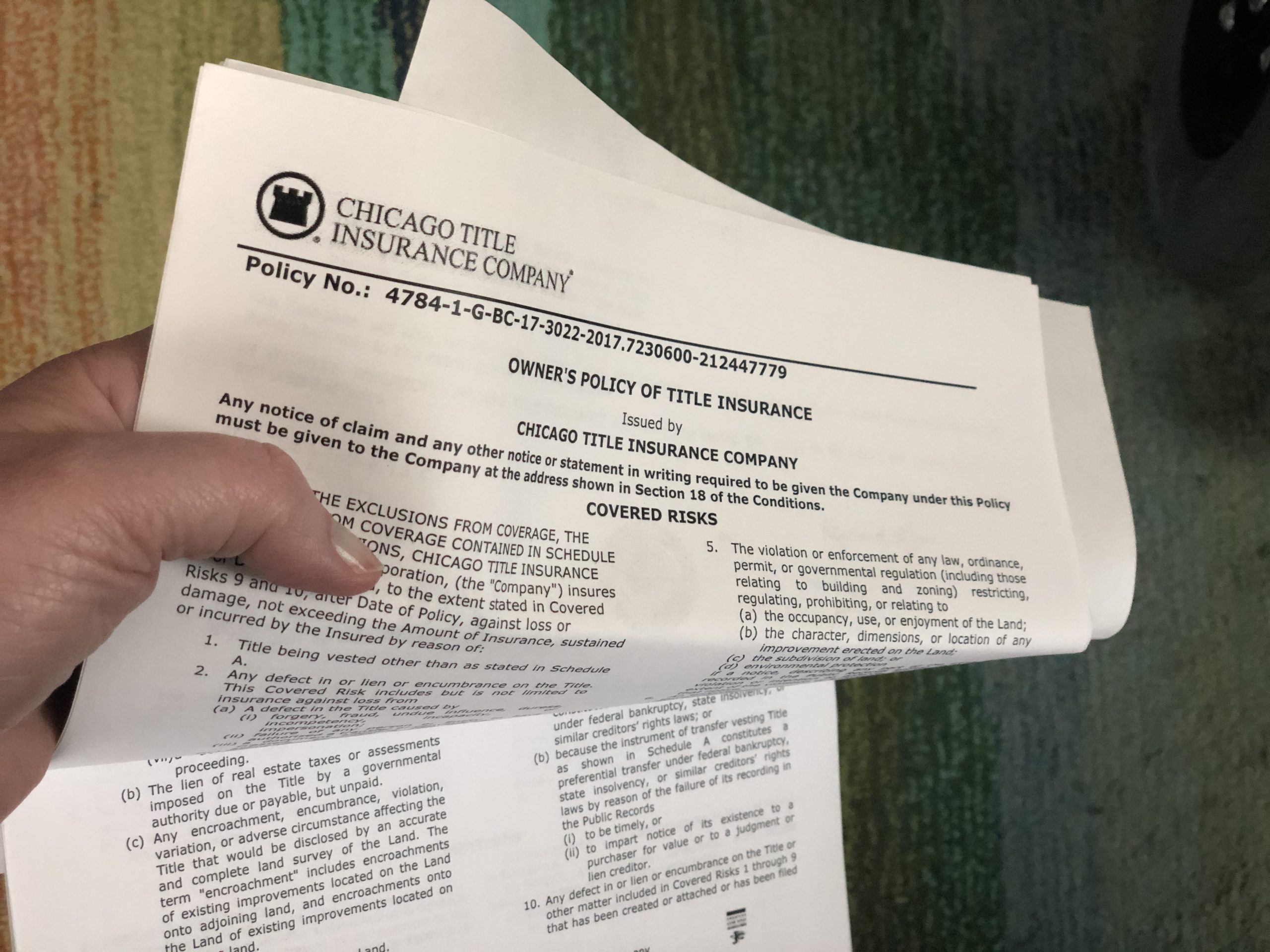

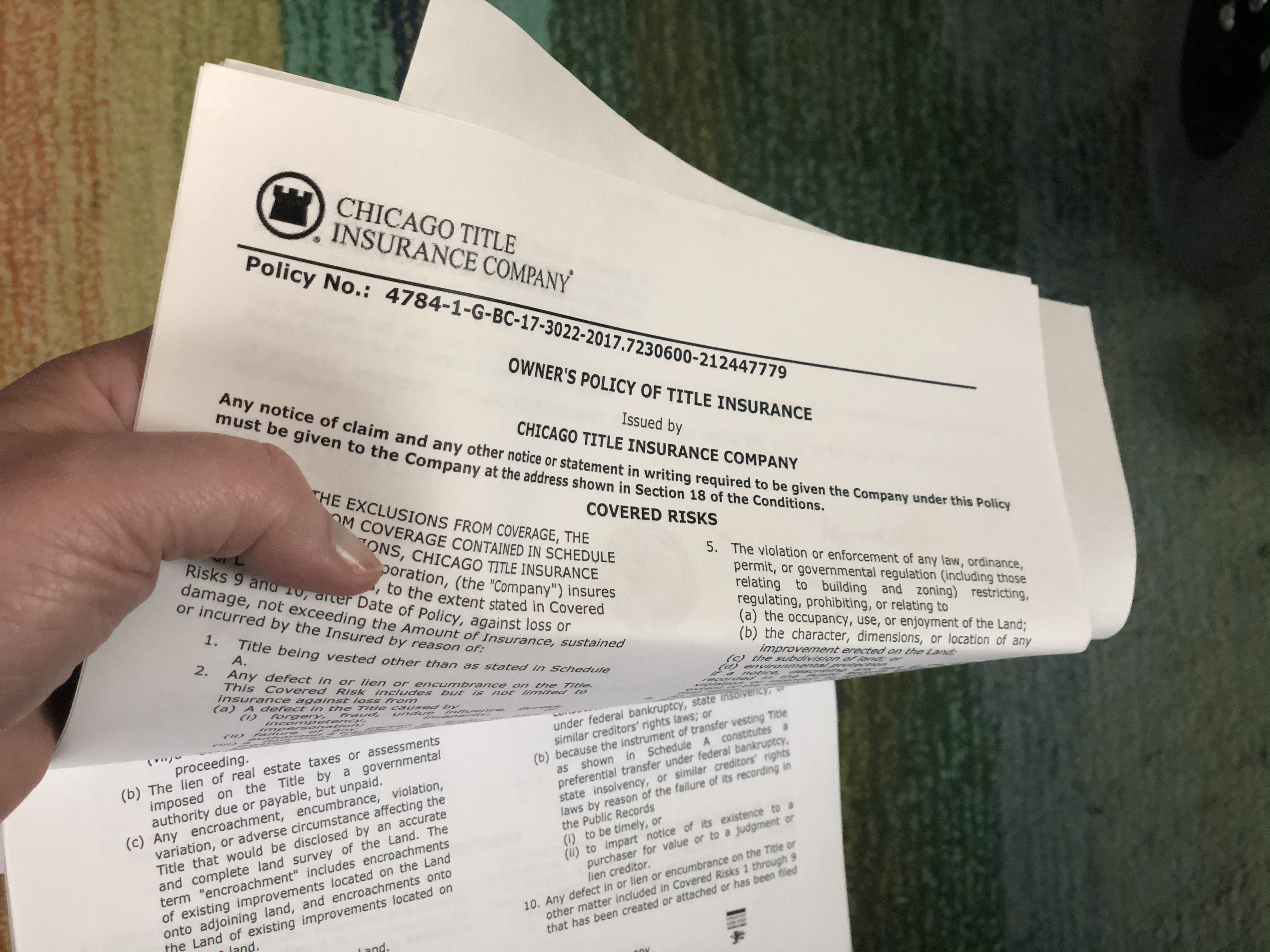

The best way to do this is to locate a copy of the most recent Owners Policy of Title Insurance. This is generally a document on legal-sized paper that arrives AFTER a closing or refinance. The document is generally not included in the closing docs themselves but arrives in the mail a few weeks later.

If you can find this, simply scan the policy and send it to your agent or title rep. If you can’t locate the physical copy, try contacting the title company where you originally closed. They should have it on file.

Providing this policy means that the next insurance issuer only needs to search claim records back as far as the last closing instead of a longer history search. Thus saving them a little time and saving you a little money.